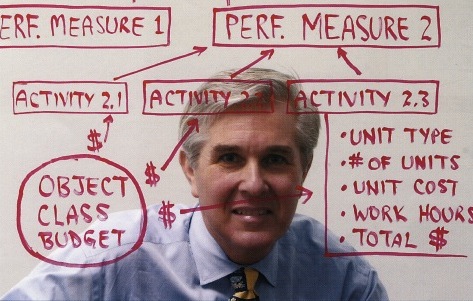

Consultant John Mercer helps agencies chart

their paths to performance-based budgeting

It is important to understand that performance-based budgeting is not simply the use of program performance information in developing a budget. Performance-based budgeting does more than just inform the resource allocation decisions that go into the development of a traditional type of budget. In other words, it is not just "budgeting based on performance." Instead, it is the process by which a particular type of budget is developed -- a Performance Budget (or "program performance budget"). To design an effective system of performance-based budgeting, it is therefore vital to understand first exactly what the end product itself should be, what it should contain, and how it should look.

A true Performance Budget is not simply a Line-Item (or object class) budget with some program goals attached. It tells you much more than just that for a given level of funding a certain level of result is expected. A real Performance Budget gives a meaningful indication of how the dollars are expected to turn into results. Certainly not with scientific precision, but at least in an approximate sense, by outlining a general chain of cause and effect. The most effective governmental Performance Budget does this by showing, for each program area, how dollars fund day-to-day tasks and activities, how these activities are expected to generate certain outputs, and what outcomes should then be the result.

A program Performance Budget can be distinguished from a Line-Item Budget in a fundamental way. The line items show what each dollar will be spent on: salaries, benefits, office supplies, travel, utilities, equipment, etc. The Performance Budget shows what each dollar will accomplish, generally in the way of a measurable result achieved (such as a reduction in accidents, an improvement in health, an increase in customer satisfaction, etc.), or in the way of an activity performed (such as process a grant application, inspect a worksite, review a compliance activity, etc.). However, every program could (and probably should) be able to show its budget in both formats -- with the "bottom line" dollar amounts being exactly the same for each.

Several performance budget examples are illustrated on this web site, including on other pages. See the illustration of a local government performance budget on the page Local Government Illustration of PBB.

The first group of tables below illustrate the relationship between a higher-level, outcome-oriented goal in an agency's Performance Budget and the next lower-level goals of the supporting programs necessary to meet that goal, as well as an alternative view of the same costs as shown in the agency's Line-Item Budget (known as an Object Class Budget in the US Federal Government). Note that the budget figures highlighted in gold are identical, while the figure in blue can be followed down to the next level of supporting goals and activities.

| Agency | Chemical Industry Safety Agency |

|---|---|

| 2018 Budget | $128,670,000 |

| 2018 Goal | Reduce the number of serious accidents in the toxic chemical industry by 6 percent from the 2015 level |

| Performance Budget Agency Outcome Goal | 2017 Planned | 2017 Actual | 2018 Planned | 2019 Planned |

|---|---|---|---|---|

| Percentage reduction in serious accidents from 2015 baseline in toxic chemical industry | 2 | 2 | 4 | 6 |

| Performance Goals | Total Cost |

|---|---|

| 1. Achieve a reduction of 7% in the number of serious accidents in the manufacturing of toxic chemicals from the 2015 baseline | $52,400,000 |

| 2. Reduce the number of serious accidents in the transportation of toxic chemicals by 3% from the 2015 baseline | 42,260,000 |

| 3. Achieve a reduction of 9% from the 2015 baseline in the number of serious accidents in toxic chemicals storage facilities | 34,010,000 |

| Total | $128,670,000 |

| Agency Budget by Line Item (Object Class) | ||

|---|---|---|

| 11.1 | Full-time permanent employee salaries | $48,015,000 |

| 11.3 | Other than full-time permanent employees | 1,525,000 |

| 12.1 | Civilian personnel benefits | 17,404,000 |

| 21.0 | Travel and transportation of persons | 2,009,000 |

| 23.1 | Rental payment to General Services Administration | 6,609,000 |

| 23.3 | Communications, utilities and miscellaneous charges | 12,878,000 |

| 24.0 | Printing and reproduction | 1,373,000 |

| 25.4 | Operation and maintenance of facilities | 8,891,000 |

| 25.7 | Operation and maintenance of equipment | 3,098,000 |

| 26.0 | Supplies and materials | 9,547,000 |

| 31.0 | Equipment | 17,321,000 |

| Total Budget | $128,670,000 | |

The tables below illustrate the relationship between measurable performance goals in the Performance Budget and the program activities necessary to meet those goals, as well as an alternative view of the same costs as shown in the program's Line-Item Budget. Note that the budget figures in blue are identical.

| Program | Toxic Chemicals Storage Safety Program |

|---|---|

| 2018 Budget | $34,010,000 |

| 2018 Goal | Achieve a reduction of 9% from the 2016 baseline in the number of accidents in toxic chemicals storage facilities and a reduction in the seriousness of the accidents so that no more than 28 hospitalizations are required |

| Performance Budget Program Goals |

2017 Planned | 2017 Actual | 2018 Planned | 2019 Planned |

|---|---|---|---|---|

| Percentage reduction in number of storage accidents from 2016 baseline | 3 | 2 | 6 | 9 |

| Number of hospitalizations required for more than one day due to storage accidents | 32 | 31 | 30 | 28 |

| Activity | Unit of Output |

Number of Units | Unit Cost |

Total Cost |

|---|---|---|---|---|

| 1. Conduct inspections of toxic chemical storage facilities | An inspection conducted | 4,975 | $2,233 | $11,110,000 |

| 2. Investigate incidents of spills and leaks | An investigation completed | 1,985 | $4,544 | 9,020,000 |

| 3. Conduct training and licensing of toxic handlers | A license issued | 4,100 | $3,385 | 13,880,000 |

| Total | $34,010,000 | |||

| Program Budget by Line Item (Object Class) | ||

|---|---|---|

| 11.1 | Full-time permanent employee salaries | $12,710,000 |

| 11.3 | Other than full-time permanent employees | 403,000 |

| 12.1 | Civilian personnel benefits | 4,602,000 |

| 21.0 | Travel and transportation of persons | 531,000 |

| 23.1 | Rental payment to General Services Administration | 1,747,000 |

| 23.3 | Communications, utilities and miscellaneous charges | 3,304,000 |

| 24.0 | Printing and reproduction | 363,000 |

| 25.4 | Operation and maintenance of facilities | 2,350,000 |

| 25.7 | Operation and maintenance of equipment | 819,000 |

| 26.0 | Supplies and materials | 2,550,000 |

| 31.0 | Equipment | 4,631,000 |

| Total Budget | $34,010,000 | |

This program Performance Budget and its Line-Item Budget are then cascaded down to the next sub-unit level, as illustrated in the following tables. Here, Activity 3 from the Performance Budget above is shown as cascaded down to the sub-activity level. Note that the budget figure in red for Activity 3 above is identical to the figures in red in both the Performance Budget and its Line-Item Budget shown below. Also note that in both of these examples, only the program (or sub-program) goals and results are shown on a multi-year basis, in order to keep the examples simple. However, an organization might find value in also tracking the multi-year trends in unit costs of an output.

| Sub-Program | Office of Licensing and Training |

| 2018 Budget | $13,880,000 |

| 2018 Goal Statement | Issue an anticipated 4100 licenses while achieving an average license trainee satisfaction rating of 3.5 on a 5-point scale |

| Performance Budget Sub-Program Goals |

2017 Planned | 2017 Actual | 2018 Planned | 2019 Planned |

|---|---|---|---|---|

| Number of licenses issued | 3,850 | 3,872 | 3,980 | 4,100 |

| Average license trainee satisfaction rating | 3.3 | 3.2 | 3.4 | 3.5 |

| Activity 3. Conduct training and licensing of toxic handlers | Unit of Output |

Number of Units | Unit Cost |

Total Cost |

|---|---|---|---|---|

| Sub-Activity 3.1. Conduct background checks on applicants | A background investigation completed | 5,260 | $783 | $4,120,000 |

| Sub-Activity 3.2. Conduct licensee training classes | A training class conducted | 550 | $13,609 | 7,485,000 |

| Sub-Activity 3.3. Provide administration and support services | Work hour | 28,715 | $77 | 2,225,000 |

| Totals | A license issued | 4,100 | $3,385 | $13,880,000 |

| Program Budget by Line Item (Object Class) | ||

|---|---|---|

| 11.1 | Full-time permanent employee salaries | $5,211,000 |

| 11.3 | Other than full-time permanent employees | 165,000 |

| 12.1 | Civilian personnel benefits | 1,887,000 |

| 21.0 | Travel and transportation of persons | 218,000 |

| 23.1 | Rental payment to General Services Administration | 698,000 |

| 23.3 | Communications, utilities and miscellaneous charges | 1,321,000 |

| 24.0 | Printing and reproduction | 145,000 |

| 25.4 | Operation and maintenance of facilities | 940,000 |

| 25.7 | Operation and maintenance of equipment | 327,000 |

| 26.0 | Supplies and materials | 1,020,000 |

| 31.0 | Equipment | 1,948,000 |

| Total Budget | $13,880,000 | |

The Government Performance and Results Act of 1993 (GPRA) has always envisioned the complete integration of the Annual Performance Plan with the Budget – what is known as “Performance-Based Budgeting” or simply "Performance Budgeting." This integration is perhaps the single most powerful tool for implementing comprehensive Performance Management within government agencies. In fact, it was a particular example of a sophisticated and very effective use of this form of budgeting that directly inspired the origination of GPRA.

In his June 2001 testimony before the House Subcommittee on Government Efficiency, John Mercer described Performance Budgeting and its relationship to GPRA. He explained some of its uses in resources allocation, program management, and accountability. Much of his understanding of the value of this type of budgeting was based on his experience in the model performance budgeting system that inspired GPRA.

This website includes a 33-page guide to the Cascade Performance Budgeting system. This guide includes 24 tables and charts illustrating a step-by-step approach on how a government agency may develop an effective performance budget.

The newly available CASCADE Performance Based Budgeting Software™ is a uniquely effective solution for addressing the strategic planning and performance budgeting needs of Federal departments and other government agencies. CASCADE presents a truly innovative approach to instilling operational planning transparency and accountability in organizations of from 50 to over 5,000 managers.

In March 2002, a white paper by John Mercer on "Performance Budgeting for Federal Agencies" was published. This paper explains what a Performance Budget is, some key steps in its development, and how it may be used.

A very important prerequisite to developing effective performance budgeting systems -- budget systems that can support comprehensive Performance Management all all levels of the organization -- was established in 1998 with implementation of a new accounting standard for federal agencies. The Federal Accounting Standards Advisory Board issued a standard for Managerial Cost Accounting that requires agencies to be able to develop a particular type of information essential to true performance-based budgeting. To cite a few lines from this standard (emphasis added):

The managerial cost accounting concepts and standards contained in this statement are aimed at providing reliable and timely information on the full cost of federal programs, their activities, and outputs. . . . In July 1993, Congress passed the Government Performance and Results Act (GPRA) which mandates performance measurement by federal agencies. In September 1993, in his report to the President on the National Performance Review (NPR), Vice President Al Gore recommended an action which required the Federal Accounting Standards Advisory Board to issue a set of cost accounting standards for all federal activities. Those standards will provide a method for identifying the unit cost of all government activities.

More information about this cost accounting reform may be found on this web site's pages on Activity Based Costing/Management and on ABC/M Compliance.

During the administration of George W. Bush, senior officials at the Office of Management and Budget described Performance-Based Budgeting as being the Administration's top management priority. The importance of this reform was emphasized in the President's Budget each year. OMB also outlined specific requirements for the initial phases of this reform, both as part of the President's Management Agenda and as key elements in the Program Assessment Rating Tool.